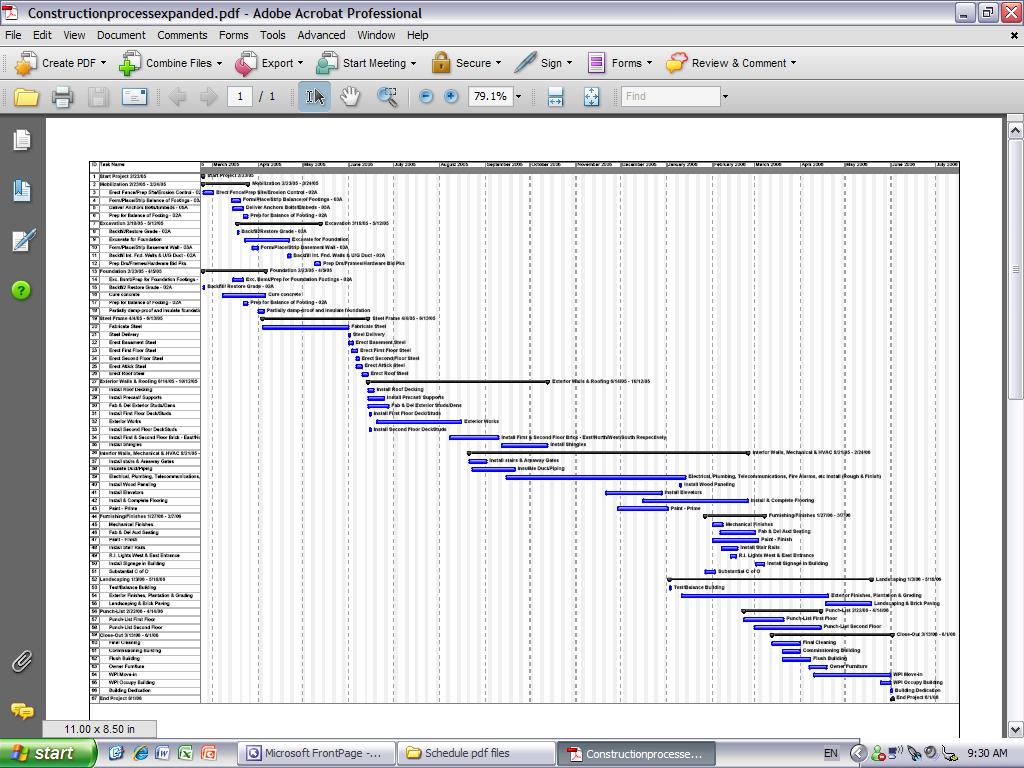

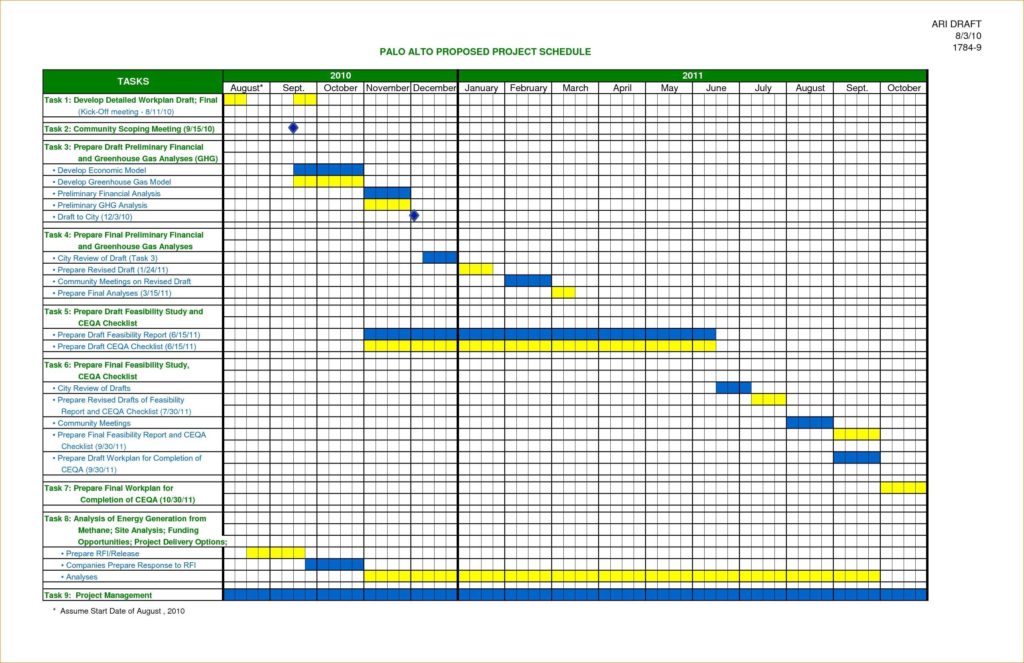

Second 20% – The second installment is normally sent out when the house is framed in, the roof is on, the windows are installed, and the exterior doors are installed. While not every construction draw schedule will look the same, here is an example of what many do look like.įirst 20% – This amount is paid out when the site development, septic, water main, laying of footer and foundation, and garage concrete pad are all completed.

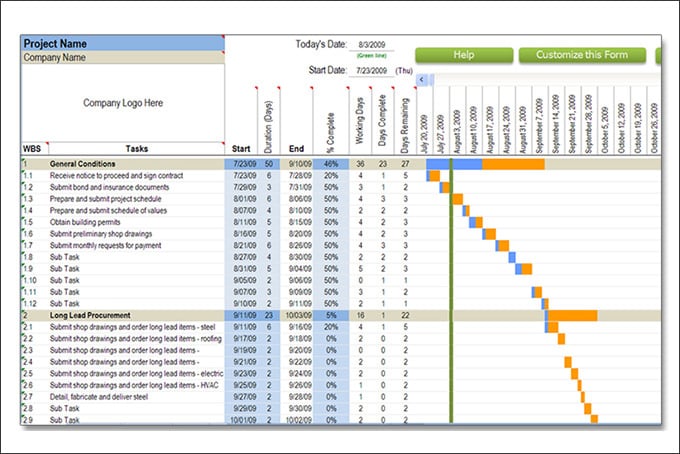

A fairly normal construction draw schedule Of course, documentation is almost always necessary and will need to be written out, while also including receipts, invoices, and sometimes proof of payment. For each draw, forms need to be completed with the names of the people and companies, the amount that is requested, and the corresponding line item from the budget. When it comes to the paperwork needed for draws, after doing one or two, most people will agree that the fewer draws there are, the better. Those fees may seem needless, but they are necessary.Ī few of those fees include the outside inspector that is always used to make sure that the completion point has definitely been met, as well as the deposit fee for wiring the money to the account. The reason for this is that it saves paperwork on everyone’s part, while also saving on fees that are associated with each draw. While there could be dozens of different points of draws, most people like to agree of the least amount. Without these agreed upon times, the construction draw schedule is useless. There is not just one basic construction draw schedule, because buyers and the bank must agree on the times when money will be released to the contractor. If a construction draw schedule is not used, money will not be dispersed, and a contractor could run out of money for the project, or the money may not be dispersed in the way that it should. This financial tool allows banks to see the progress and then release funds to keep the project moving forward. Your information will be kept completely private.A construction draw schedule is basically what is used by contractors to identify specific completion points of a job. Please contact Charley at (603) 471-9300 or via email to get started with rates and information. Get the details now by downloading this PDF! Construction Loan Program - HarborOne No need to provide updated tax returns, pay-stubs, etc. You can sleep with ease knowing that your financing is in place and locked down. ONE approval. Means no surprises once you close.Draws must be approved by BOTH borrower and builder. ONE draw schedule. With up to eight draws during construction.ONE option. For both conforming and jumbo mortgages.ONE program. Available for both primary residences and second homes.ONE modification form. To be signed after completion to amortize the loan over the remaining 29 year term (or 14 if you choose the 15-year option.).ONE payment. You pay interest-only monthly during the initial 12 months of mortgage.ONE mortgage. It covers both the construction term (12 months) and the remaining 29 years.

0 kommentar(er)

0 kommentar(er)